The survey has revealed that even though the youth have 55% of the spending power in their own right, only 20% of advertising budgets are directed at the youth market.

Additionally, most of South Africa’s corporate marketers are bypassing the youth market a 46% slice of today’s consumers.

Although they may not yet have the buying power of their parents, the youth are key decision-makers when it comes to identifying trends, promoting brands and influencing the majority of household buying decisions.

Even though they have 55% of the spending power in their own right, only 20% of advertising budgets are directed at the youth market, reports the Gen Next survey.

Secondary school learners between the ages of 14 and 18 and youth who have completed their schooling and are between the ages of 19 and 24.

Although the spending balance rests with parents and older consumers, the data reveals just how seriously the market should be considered. Direct and indirect youth expenditure is R131.2-billion annually.

Of the total, children spend R38.7-billion; teens spend R47.9-billion and young adults spend R44.6-billion.

Most youth surveyed had definite ideas about what would make them favour a brand. 88% said that good service would make them talk about a brand.

The survey also showed that 85% would discuss a brand that made them feel original and unique and 81% said good quality would be a talking point.

“Organisations failing to recognise young market influences are failing to ‘future-proof’ their companies by making sure that their brands are entrenched with a generation whose influence is going to develop into buying power within the next five to 10 years,” says Chinkanda.

“Engaging with 15 year olds means that you are establishing a relationship with consumers who, in a decade, will be making major purchasing decisions. Just as important is the fact that today’s youth are the first to adopt new technologies and digital platforms,” Chikanda adds.

“Companies must be adaptable and develop their marketing so that it is in sync with market changes — particularly when it comes to using social media as a medium,” says Chikanda. “An example in point are the changes taking place in the influencer market.”

Content creators have to be aware of shifting trends when devising material for posting on social media platforms.

This is applicable in posts where endorsements are a stock in trade and are regarded as essential in persuading young buyers to not only follow the exploits of a favoured celebrity but also to adopt his or her behaviours and buy the endorsed products.

Up until recently, it was enough to have celebrities endorse services and products. Now, younger readers want their reference points to be experts in the matter being discussed.

“Where a company could use an actress to underwrite, say, a new camera, the younger market now demand that the blogger is a photographer of national or international repute,” says Chikanda

“Content creators have to be quick to recognise that influencers have to conform to new expectations. Marketers who are not aware of the young consumers’ drive for authenticity could, therefore, be not only using the incorrect influencers but be creating posts where the language is also inappropriate,” Chikanda adds.

“Phrases and wording that do not ring true could mean a reduced following, a credibility gap and the potential for a significant portion of corporate spending power to be jeopardised,” adds Chikanda

“Keeping track of how youth interact with and respond to brands means that companies need to be aware of which social media platforms are favoured,” Chikanda says.

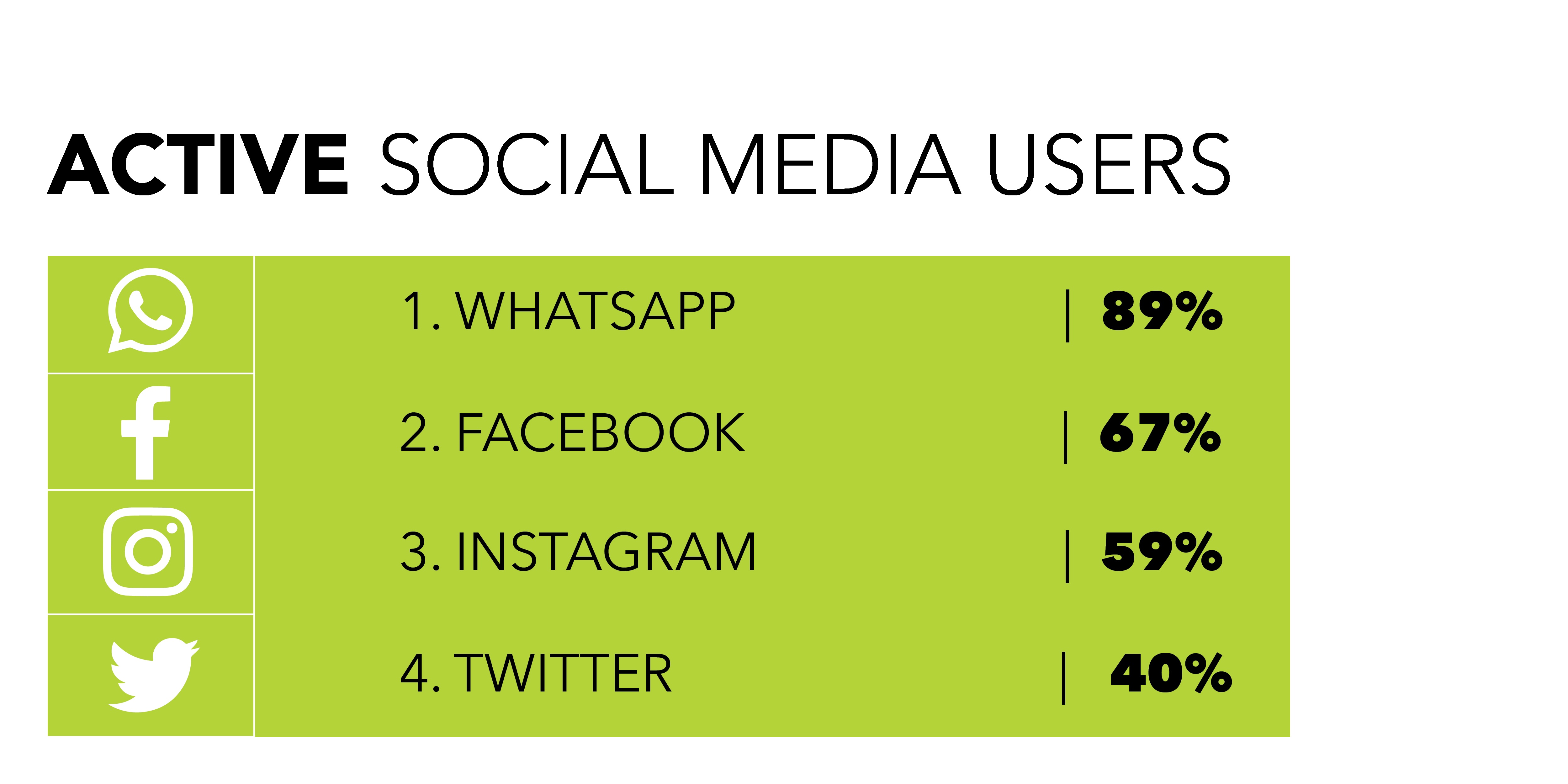

The 2019 Gen Next research showed that, of active social media users, 89% of youth used WhatsApp, 61% Facebook, 68% used Instagram and 43% used Twitter.

WhatsApp was rated the ‘coolest’ platform (28%) followed by Instagram (17%) while received only Facebook (14%).

“Despite all this information underlying the importance of the youth market, the reality is that, to many marketers, [the] youth is an afterthought. They are just not considered in long-term marketing strategies,” says Chikanda.

“Worse still is the boardroom realisation that when the youth market must be regarded as a market segment, marketers — without the backing of research — launch products and services based on what they feel the youth want,” Chikanda adds.

“The corporate conversation needs to change. Instead of being focussed on ‘our youth challenge’ it should be rather identifying ‘what our opportunities are’,” says Chinkanda.

“The most overused word in youth marketing is ‘hustle’. Our research shows that, far from being hustlers, young people want security,” Chikanda says.

“For example, our research shows that middle-class childrens’ future focus is on employability. Youth from upper-middle-class backgrounds worry about the jobs of the future, the correct university and the skills that will enable them to compete on a global level,” adds Chikanda.

Research also shows that the youth have the power to decide on what they buy and where they buy it. However, young buyers are still influenced by their parents, who still play the role as effective gatekeepers when it comes to formulating responses to markets.

When asked what skills they wished to pursue, some of the responses were:

- 19% of youth desired business and executive skills

- 9% of youth wanted financial and money skills

- 7% of youth desired IT skills

Mobiles are the technological common factor. When it comes to mobiles, 25% of South Africa’s youth check their phones every five minutes, while 71% check phones at least once an hour.

The research also found that:

- 77% owned mobiles

- 90% gaming consoles

- 59% smartphones

- 33% laptops

- 31%TV’s and HD Tv’s

- 35% Ipads and tablets

The average South African child spends an average of two hours and 30 minutes online every day. Time spent online varies from:

- an hour and 30 minutes for children

- two hours and 50 minutes for teens

- three hours and 30 minutes for young adults

Additionally, males spend about three hours and 11 minutes a day online, while females spend three hours and four minutes.

“The youth market in South Africa is populated with individuals from urban and rural areas of differing levels of education and with different expectations of life,” Chikanda adds.

“It is a vital market that needs to be understood and correctly catered for if it is going to be catered to,” concludes Chinkanda.

For more information, visit

www.hdiyouth.com. You can also follow HDI Youth Consultancy on

Twitter or on

Instagram.